The LNG industry has faced many challenges during 2020 and will continue to be tested in 2021. How quickly will global demand for LNG recover, and therefore how quickly will additional liquefaction capacity be required? Over the past few months, I’ve been approached by LNG liquefaction projects, all of them looking to answer the same question: When should we target the closure of our Sales and Purchase Agreements?

The answer to that important question is far from being simple or something that you robustly develop over a video conference so I thought in sharing a few of the many aspects you should consider when trying to answer the timing related question.

LNG Market Outlook

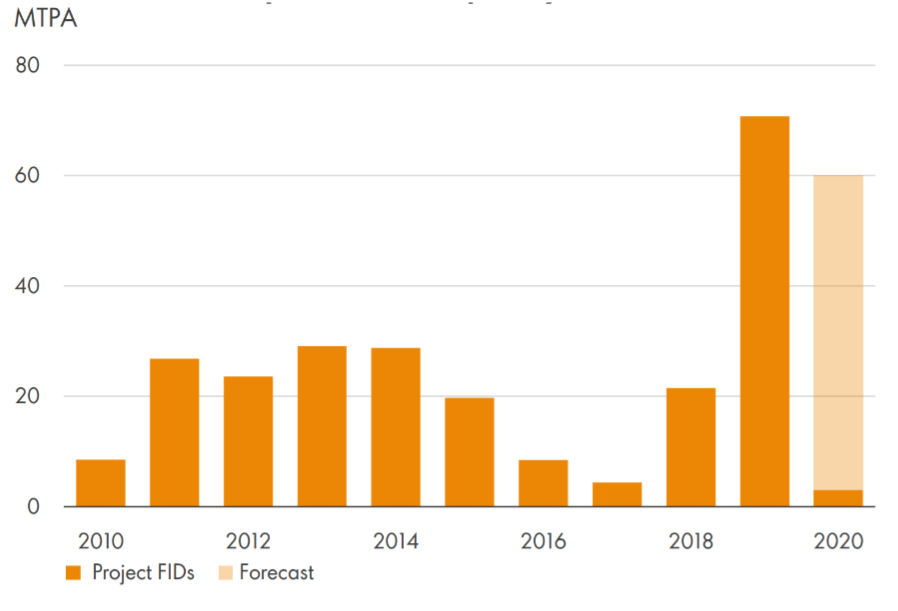

The LNG industry is cyclical in nature with periods of under-investment followed by periods of over-build. Investments in new LNG supply hit a cyclical low over the period 2015 to 2017 (see Figure 1). Spot prices of LNG at any given time reflect the LNG market balance at that point in time. The low ratio of LNG spot price in Asia to Brent, is reflective of the current LNG market which is seeing supply side additions far outstrip demand. This dynamic is expected to continue in the near future and as a result, both spot and long-term prices could likely stay subdued to 2021/22. This is a market window which could prove tough for projects which have not as yet locked down commercial terms. Paradoxically, as most liquefaction projects are pushing their FIDs to the end of 2021 or straight into 2022, that is when we can expect to see a surge of pre-FID projects more actively chasing demand or trying to secure biding Sales and Purchase Agreements, in which case it could put further downward pressure on prices (this is one of the many outcomes which a project should assess and discuss in detail or seek for external support).

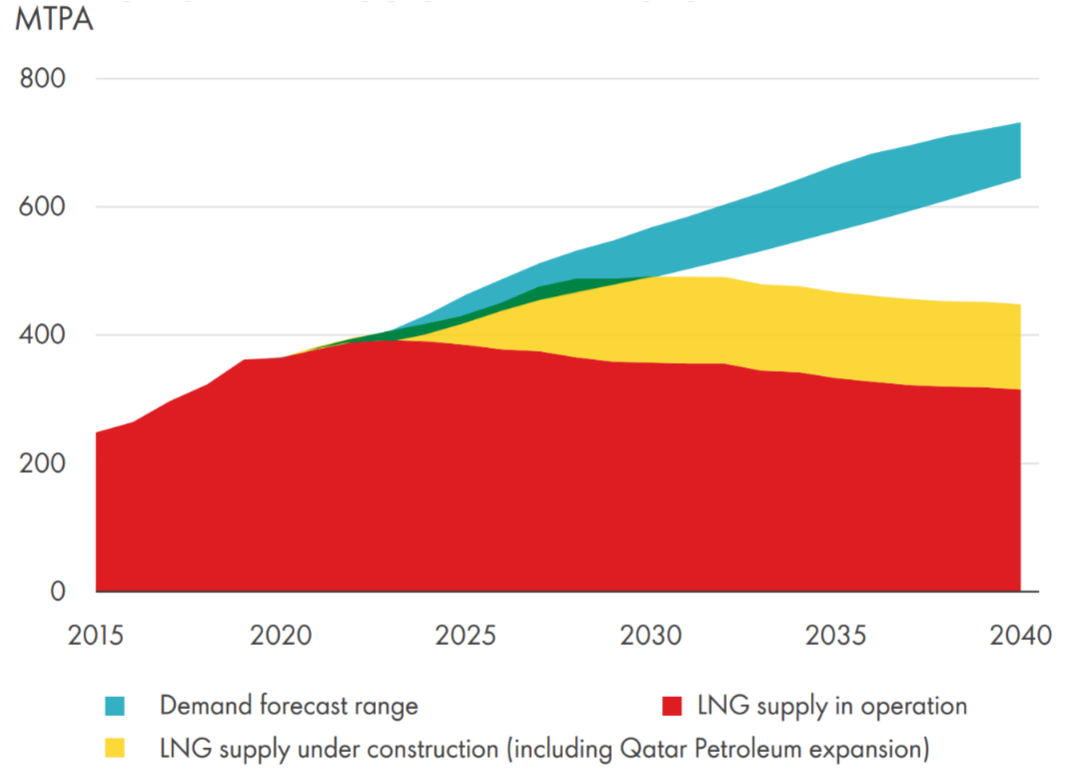

Depending on which LNG market outlook you consider for the decision-making process, we could argue that post 2022/23, the LNG market cycle is expected to turn again and a tight market could re-appear during the period 2023 -2025 (see Figure 2).

The outlook beyond 2025 will be influenced by how much capacity and how many developers can get their projects to FID in the next few years. Rationally, Buyers should try to conclude new long-term deals in the 2021/22 period (when the market is expected to be weakest), while Sellers should try and do deals only once the market begins recovering.

Figure 1: Investment in liquefaction capacity additions

Source: Shell LNG Outlook 2021

Figure 2: Emerging LNG supply/demand gap

Source: Shell LNG Outlook 2021

The above describes the traditional rationale which can be affected by events like Total’s 26 April 2021 force majeure declaration by which it confirmed the withdrawal of all Mozambique LNG project personnel from the Afungi site, signalling delays on its onshore Mozambique LNG project. At this point, the ExxonMobil’s yet-to-be sanctioned Rovuma LNG will also be affected. Together the two projects represent 28 MTPA of LNG capacity which might temporarily disrupt global balances. Might Qatar and other LNG producers take this opportunity to allocate flexible or uncontracted volumes?

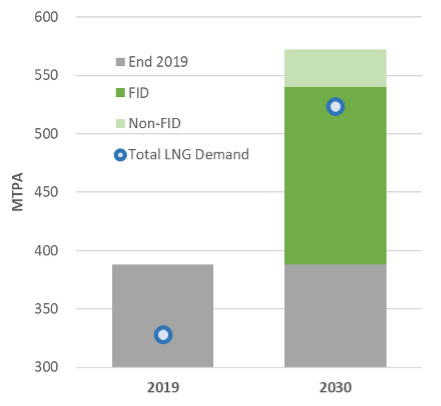

There are around 200 MTPA of pre-FID capacity chasing the 2030 market window (see Figure 3). Clearly, not all of this will get built but even if part of this capacity gets to FID, the market window until 2030 could get locked up. A key change in the LNG industry is that much of this capacity is being financed on the basis of equity sales which means that the developers do not need to find end-user buyers to take FID. Further, these projects are being financed based on the strong balance sheet of the promoters with the promoters accepting the risk of ‘warehousing’ the LNG on their books for sales down the road in the expectation of higher market prices.

The current list of pre-FID projects on top of those LNG projects sanctioned over the past years, could give rise to a new “wave of capacity additions” from 2025/26. LNG demand in this same period, while still expected to grow, is not expected to be strong enough to absorb all of the supply until post 2030. In short, the market could witness a substantial oversupply situation particularly towards the end of this decade. The prospect of this situation materializing is exacerbated by many projects willing to sanction projects without real end user demand effectively warehousing LNG on their own books.

Figure 3: LNG export capacity growth

Source: OIES Internal scenarios

Target Markets

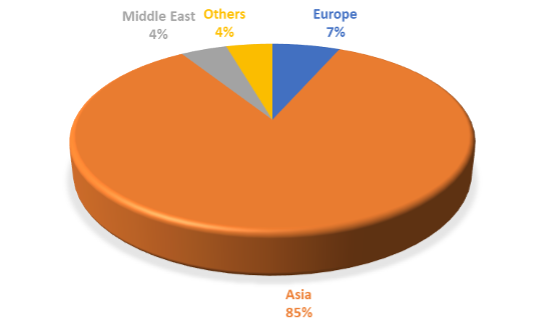

Asia is expected to continue to be the dominant LNG market in the long term given its lack of cross-border pipeline connectivity and large and growing population (see Figure 4). Europe is expected to be the second largest key market after Asia. Although demand in Europe will not grow as strongly as Asia, declining indigenous production – especially the giant existing Groningen gas field – as well as continued efforts to reduce reliance on Russian pipeline gas will result in Europe being the second largest import region after Asia.

At a country level, eight of the top ten countries with the highest demand and supply gap for LNG are in Asia. China and India – driven by population and economic growth – will be the two largest LNG buyers. Japan and Korea while showing lower absolute growth given the more mature status of their economies, will still have a large demand and supply gap in LNG given many existing LNG contracts in both countries will expire in the next years and will need replacing.

Lastly, southeast Asia – in the form of Pakistan, Vietnam, Thailand, Bangladesh, Indonesia, and the Philippines – will be the new emerging LNG importing countries where demand growth will be driven by a combination of strong power demand and decreasing domestic production.

Figure 4: Regional Incremental Imports (2019-2030)

Source: OIES Internal scenarios

What is next?

The above are a few of the many aspects you should consider when trying to find the best timing to close your Sales and Purchase Agreements.

With each project being unique (greenfield, brownfield, geographical location, need for project financing, sell FOB or DES and the list can continue) there are other plausive market and shipping scenarios we can help you to assess, especially in view of an industry evolving towards zero CO2 emissions in the next few decades to come.